Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

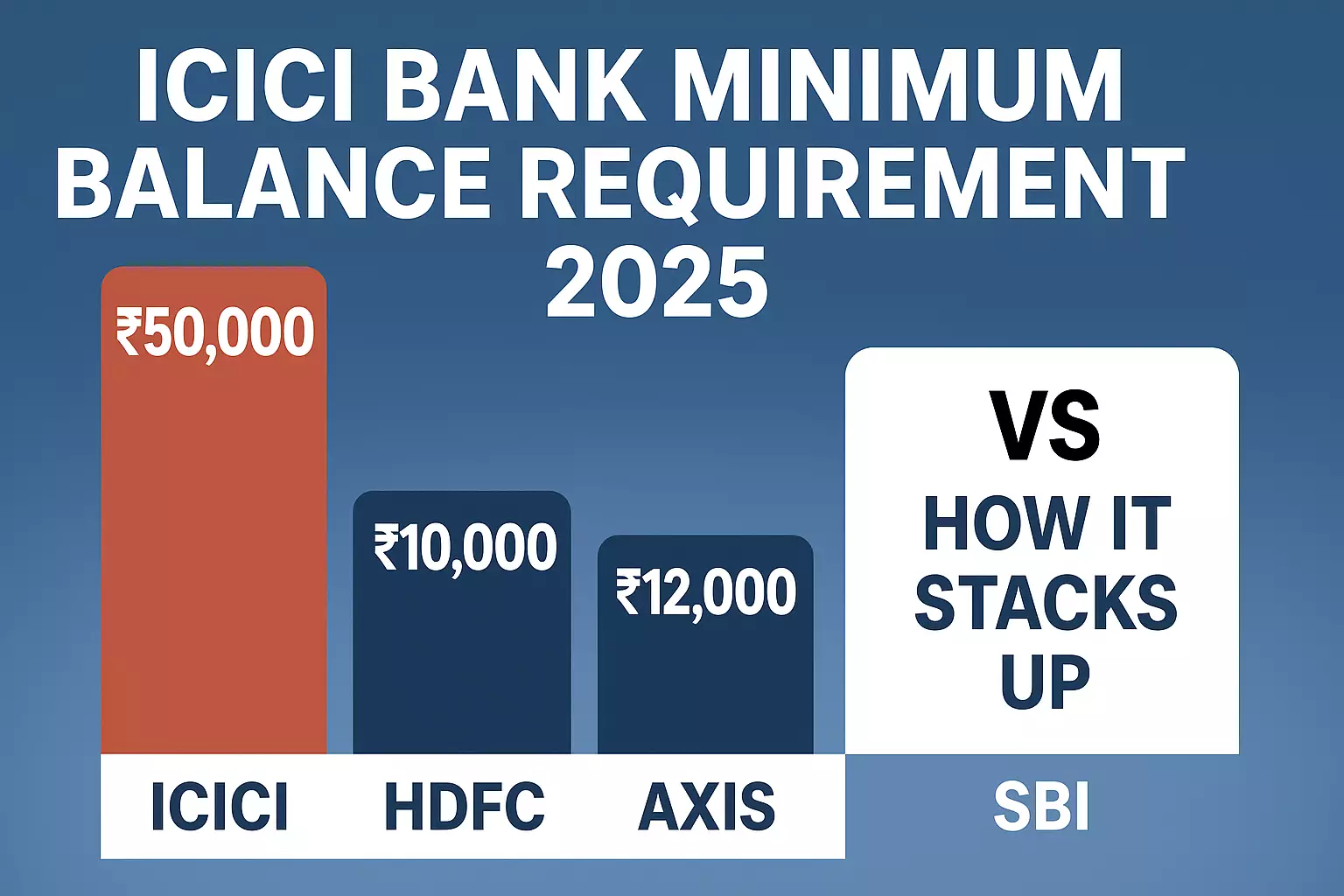

Starting August 1, 2025, ICICI Bank has implemented one of the steepest hikes in the minimum balance requirement in recent banking history. The new ICICI Bank Minimum Balance Requirement 2025 for newly opened savings accounts in metro and urban areas has risen from ₹10,000 to an eye-watering ₹50,000 — a fivefold increase.

This change applies only to new accounts opened on or after August 1, 2025. If your account was opened before this date, your older, lower minimum balance rules still apply.

For new customers in semi-urban branches, the new MAB is set at ₹25,000, while in rural branches it’s elevated to ₹10,000. Existing customers in these regions continue under the previous thresholds of ₹5,000.

Missing the mark on these new requirements comes with a penalty: either 6% of the shortfall or ₹500, whichever is lower.

For new savings account holders:

For existing customers (before Aug 1, 2025):

If new customers fail to maintain the ICICI Bank Minimum Balance Requirement 2025, the bank will impose a penalty of 6% of the shortfall amount or ₹500, whichever is lower.

| Bank | Urban / Metro MAB | Semi-Urban MAB | Rural MAB | Notes |

|---|---|---|---|---|

| ICICI (new) | ₹50,000 | ₹25,000 | ₹10,000 | Applies only from Aug 1, 2025 |

| ICICI (existing) | ₹10,000 | ₹5,000 | ₹5,000 | No change for old accounts |

| HDFC Bank | ₹10,000 | ₹5,000 | ₹2,500 | FD-based criteria possible |

| Axis Bank | ₹12,000 | ₹5,000 | ₹2,500 | — |

| SBI | Zero-balance | Zero-balance | Zero-balance | No MAB requirement |

| Other PSBs | Zero-balance | — | — | Removed MAB entirely |

If you’re planning to open a new ICICI Bank account in a metro area, be ready for a steep entry barrier. Maintaining ₹50,000 every month could be challenging for many individuals, especially students and early-career professionals.

For existing ICICI Bank customers, this policy change doesn’t affect you — you can continue following your old MAB rules.

The ICICI Bank Minimum Balance Requirement 2025 hike highlights a growing divide in the Indian banking landscape:

This move could influence customer migration towards zero-balance options, especially in rural and semi-urban areas.

₹50,000 for new accounts from August 1, 2025.

No, old MAB rules still apply.

6% of shortfall or ₹500, whichever is lower.

SBI offers zero-balance accounts.

HDFC, Axis, and many public sector banks.